#business accounting and taxation

Explore tagged Tumblr posts

Text

Business Accounting and Taxation (BAT): Salary, Career and Scope

Explore the Business Accounting and Taxation (BAT) course—salary, career scope, and opportunities. Find a business training institute and BAT course near you for a successful career.

#bat course#business accounting and taxation#business accounting and taxation course#business accounting and taxation course fees#business accounting and taxation salary#diploma in accounting and taxation salary#bat course salary#business accounting and taxation salary per month#bat course near me#bat course job opportunities#business accounting and taxation (bat)#bat course duration and fees#bat course details#bat course duration#bat salary in india#b.com taxation job opportunities

0 notes

Text

Professional Business Accounting and Taxation Services for Your Company

At Conroy & Associates Inc, we offer top-notch accounting and taxation services for businesses of all sizes. Our team of certified professionals will work with you to manage your finances and ensure that you stay compliant with tax regulations. Trust us to handle the numbers, so you can focus on growing your business. Contact us today for a consultation.for information visit our website :- https://conroyassociates.com/

0 notes

Text

Better Business Compliance services With Kites corporate

Looking for top-north business compliance services? Kites corporate offer experts best outsourcing accounting services,business accounting and taxation to streamline your operation. Contact us for reliable outsourcing legal services and more.

0 notes

Text

Jm Personal Income Tax Accountant

When it comes to personal income tax, having an experienced accountant by your side can make all the difference. At JM Personal Income Tax Accountant, we offer a range of tax preparation services to help you file your taxes accurately and on time. Our team of experts has a deep understanding of the tax code and is committed to helping you maximize your deductions and minimize your liabilities. We take pride in our personalized approach to each client, ensuring that you receive the attention and care you deserve.

#Earned Income Tax Credit#Filing Self Employment Taxes#Accounting And Taxation Services#Best Accounting Firms Near Me#Business Accounting And Taxation#Business Tax Preparation#File Business Taxes Online

0 notes

Link

the most popular is the certification course on GST. After completing their practice-based courses, the students are also provided with campus placement.

#business accounting and taxation#business accounting and taxation course near me#accounting classes online#best online accounting courses#accounting course online#online accounting certificate courses

0 notes

Text

Ready to grow your tax filing business? Check out our proven strategies to attract more clients during tax season and build lasting relationships!

Visit us for more info:👉 🌐 www.varundigitalmedia.com 👉 📧 [email protected] 👉 📲 (+1) 877-768-2786

#taxseason#digitalmarketing#strategies#taxfiling#cpa#cpafirms#cpamarketing#targetedads#paidadsforcpa#provenstrategies#socialmediamarketing#taxes#tax#accounting#business#smallbusiness#taxpreparer#bookkeeping#taxprofessional#taxrefund#accountant#taxreturn#finance#entrepreneur#taxtips#businessowner#accountingservices#taxation

10 notes

·

View notes

Text

What Are the Legal Requirements and Benefits of Company Registration in Egypt?

Since 1981, YKG Global has helped businesses navigate complex regulatory landscapes, making processes like company registration in Egypt simple and efficient.

Legal Requirements for Company Registration in Egypt Egypt is a gateway to African and Middle Eastern markets, making it an excellent choice for business expansion. Key requirements include:

Selecting the right business structure (LLC, joint stock, etc.). Preparing Articles of Incorporation. Registering with the General Authority for Investment (GAFI). Opening a corporate bank account and fulfilling capital requirements. YKG Global’s team handles these steps efficiently, ensuring compliance with Egyptian laws.

Benefits of Registering in Egypt Access to a growing economy and free trade agreements. Strategic location connecting Africa, Asia, and Europe. Incentives for foreign investors in specific industries. Choose YKG Global for a Seamless Process With a proven track record, YKG Global ensures smooth company registration in Egypt while you focus on growing your business.

Contact Us Today! Let YKG Global simplify your expansion into Egypt. Reach out to our experts now!

#business#consulting#company registration#taxation#finance#accounting#foreign company#business registration#investing#success#egypt business registry#register a company in egypt#company formation in egypt

2 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

3 notes

·

View notes

Text

Best Recruitment Services Agency | Global HR Solution

website :https://globalhrsolutions.in/recruitment-services

#hr solutions#human resource solution#hr#hrm#temporary staffing#contractual recruitments#contractual staffing#outsourcing service#outsourcing taxation#outsourcing accounting#outsourcing finance#business consulting#staffing#contractor#placement consultancy#placement agency#human resources#recruitment#hrmanagement#payroll#hiring#talent acquisition#corporate compliance#executive search#global hr solutions#b2b services#b2b lead generation#b2bmarketing#outsourcing#onlinebusiness

2 notes

·

View notes

Text

#accountancy#accounting#accountant#commerce#finance#accounts#business#tax#education#taxation#accountantlife

5 notes

·

View notes

Text

How Taxation Works

Taxes are a significant part of the financial framework, and they're not always easy to understand. In fact, many people don't fully grasp how taxes work.

So, let's cover the basics of taxation so you can see how it fits into the bigger picture. I'll go into just what you need to know about taxes so that you can maximize your benefits.

WHO MUST PAY TAXES?

Taxation is based on earnings. So, anyone that is making money must pay taxes. This includes:

Individuals that are employees and earn a paycheck.

Individuals that earn an income through sources other than employment like independent contracting, freelancing, self-employed, and digital nomads work online while traveling the world. These individuals receive 1099 from their clients.

Otherwise, you’re likely the owner of a registered business. Your Business earns revenue and must file a tax return to pay its taxes.

HOW MUCH SHOULD YOU PAY?

How much in taxes a business pays largely depends on the type of taxes. There are five major kinds of business taxes:

GROSS RECEIPTS refers to sales. The goal is to reduce sales by taking tax deductions, thereby lowering taxes due.

EMPLOYMENT WITHHOLDING TAX is deducted from employees' wages when payroll is processed. As an employer, you are required to match some of those taxes and pay the employer withholding taxes portion.

CORPORATE FRANCHISE TAXES, also known as privilege tax, is a tax paid by certain companies that wish to conduct business in specific states.

EXCISE TAX is taxation on specific goods and services as you purchase them, like fuel or tobacco or alcohol for example.

VALUE ADDED TAX VAT is a consumption tax on goods and services, or when you the seller add value to those products and services.

HOW TO LOWER YOUR TAXES

The process is the same for both personal and business. However, the type of deductions and other factors vary. For example,

INCOME TAX (personal wages) - the goal is to reduce income earned by taking deductions, credits, and allowances to lower the gross income down to a Net Income amount. This lower amount (net income) is what is used to determine your tax liability based on your household. Theoretically, a single person with a $5000 net income should pay more taxes than a family of four with the same net income.

GROSS RECEIPTS TAXES (sales revenue) – is generally what is referred to for business. The goal is to reduce sales revenue by taking business deductions to lower the gross sales down to a Net Profit or Loss amount.

Businesses are allowed to deduct expenses, fancy “allowances” like depreciation on assets, or make extraordinary purchases for example. This may seem suspect to common folk, but the fact is, this is how the wealthy can move the billions they earn into lower tax brackets.

Make “NOBOSS Moves”

Now that you know how taxation works, you can take advantage of tax deductions and allowances too. But bear in mind that you're not operating on the same financial level as the wealthy. You must make every dollar count.

That being said, spending money just to take a deduction is NOT smart. There is even a commercial of a group of entrepreneurs fighting over the restaurant check because they can take a business deduction. This is highly misleading, and I'll give you two reasons why:

You’re spending money now so you can get it back later. What’s the benefit of that? This concept does nothing more than disrupt your cash flow.

Not all deductions are 100% deductible, specifically Food & Drink (Meals Exp) is only 50% deductible!

You want to make some “NOBOSS moves” by investing your money into income-generating opportunities. Depending on the type of “NOBOSS moves” you make you might be able to reduce your net income, reduce your taxes, and make money too!

KEEPING GOOD RECORDS

When you start your new business, you should also set up your bookkeeping system. One of the biggest mistakes a new business can make is waiting to set up its bookkeeping system. This is a dangerous financial mistake that happens far too often.

Keeping good records is the foundation of financial management. Documenting your business activity from the first expense is critical to building your business and minimizing taxes.

Start with a bookkeeping system that is simple and easy to update on a regular basis. No law says you must have a bookkeeper, accountant, or CPA when you start your business, so you have a few options to consider who will maintain your records properly:

Do your own bookkeeping.

Hire a bookkeeper.

Outsource to a bookkeeping service like AccountSOFT. Find out more about their implementation, bookkeeping, and training services for new business owners.

Considering you are required to pay taxes, you will ultimately make a decision by year-end so that your Tax Preparer or CPA can review your records, lower your taxes, and file business tax returns.

This information is part of the Should You Incorporate series. For more information about Legal Biz Structures, How Taxation Works, How to Pay Yourself, Starting a Business, or NOBOSS tools and resources for entrepreneurs, please visit our website at www.noboss.business

#tax#taxation#financial#incorporating#business#corporate#revenue#bookkeeping#records#accounting#how taxation works

2 notes

·

View notes

Text

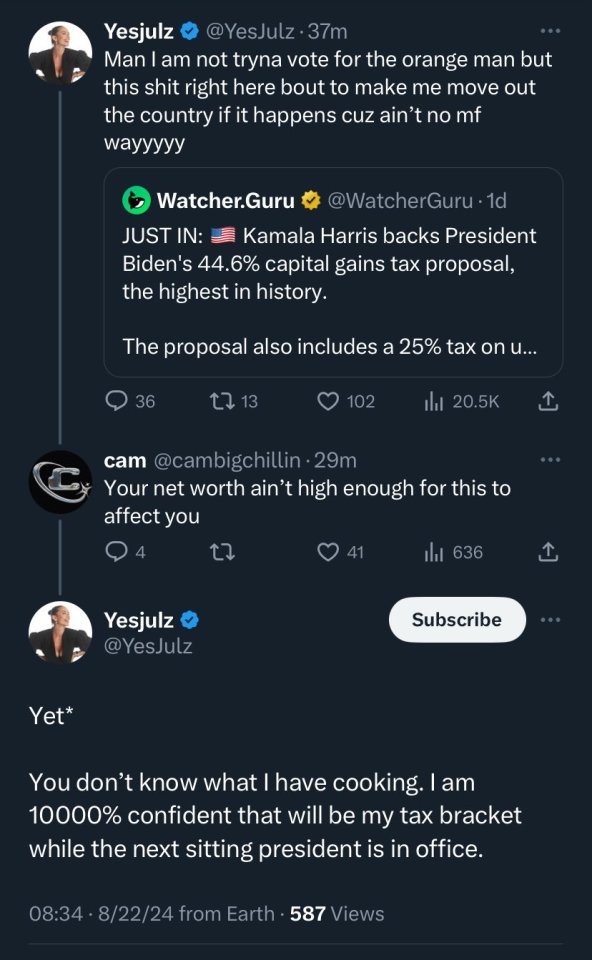

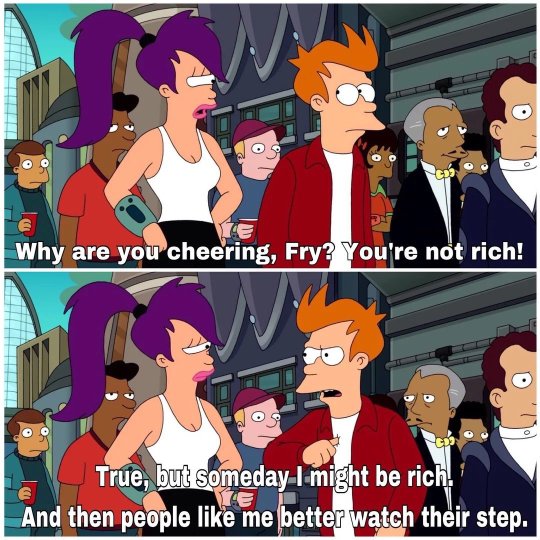

Trumps Tax Act already did this. He gave the 1% a tax break while increasing everybody else's taxes (meaning u and me) incrementally over an 8 year period. A lot of people complained about taxes going up during Bidens administration, not realizing that it was Trump who signed the law that changed the system.

Multiple democrats have campaigned on leveling the playing field by holding rich people to the same taxation standards that you and I are held to, but we have a nonzero number of congressmen and supreme court judges who are payrolled by the 1% (look up the Koch PAC for context, it's not even the only one), and when your paycheck comes from the 1%, you cannot support bills about taxing them. When you go against your employers interest, you get fired (losing re-election, in this case).

The more socialist a candidate is (which Kamala and Biden are not even a little bit), the less likely they are to have super-rich supporters because the super-rich cannot sustain their income in a socialist democracy. Bernie Sanders and Elizabeth Warren support taxing the rich, and they are among the most socialist presidential candidates I have seen in my short lifetime. Taxing the rich is not a scheme to hurt the poor, it is integral to ending the wealth disparity. You and I are already being taxed more than the wealthiest 1%, the democrats are just trying to do is level the playing field.

#also lololol idk if u have ever met a millionarie but they All hide their wealth in businesses#businesses have way more tax loopholes than individuals so most rich people hide their wealth in corporate bank accounts#and then withdraw from them like personal bank accounts sans the personal bank account taxation#(this is also how deadbeat dads dodge child support payments bc the govt cant take ur money if you have none)#(if none of your paychecks or bank accounts have your name on them then the govt cant take money from you)#(the middle class and the super rich use this for different reasons but the end goal is avoiding paying what they fucking OWE)

67K notes

·

View notes

Text

Global Business Accounting, HR & Payroll Outsourcing services

Kitescorporate Services provides companies registration services, due diligence audit, legal services, statutory HR audit services, accounting, bookkeeping, and payroll outsourcing services to help you manage your finances efficiently.

#company registration services#business accounting and taxation#best outsourced accounting services#best virtual cfo services

0 notes

Text

Small Business Tax Tips: How to Minimize Your Tax Liability

Small business owners are a vital part of the economy, creating jobs, and providing valuable goods and services to their communities. However, one of the challenges they face is managing their taxes. Tax laws can be complex and confusing, and failing to comply with them can result in fines, penalties, or even legal action. In this blog post, we will provide some helpful tips for small business owners on how to manage their taxes and minimize their tax liability.

Keep Accurate Records Keeping accurate records is essential for small business owners who want to manage their taxes effectively. You need to maintain records of your income, expenses, receipts, invoices, and bank statements. This information will help you prepare your tax returns, track your deductible expenses, and identify areas where you can save money.

Understand Your Tax Obligations

As a small business owner, you need to understand your tax obligations. This includes knowing which taxes you are required to pay when they are due, and how to file your tax returns. Some of the taxes you may need to pay to include federal income tax, state income tax, sales tax, payroll tax, and self-employment tax.

Take Advantage of Tax Deductions

Small business owners can take advantage of several tax deductions that can help them minimize their tax liability. Some of the deductions you may be eligible for include:

a) Home office deduction: If you work from home, you may be able to deduct a portion of your home expenses, such as rent, utilities, and insurance, as a business expense.

b) Business expenses: You can deduct expenses that are necessary and ordinary for your business, such as office supplies, travel expenses, and advertising costs.

c) Retirement contributions: You can deduct contributions to a retirement plan, such as a 401(k) or IRA.

Hire a Tax Professional

Managing your taxes can be a time-consuming and complex process. Hiring a tax professional can help you navigate the tax code and ensure that you are complying with all applicable tax laws. A tax professional can also help you identify areas where you can save money and maximize your tax deductions.

Plan Ahead

Tax planning is an essential part of managing your taxes. By planning ahead, you can take advantage of tax-saving opportunities and minimize your tax liability. Some tax planning strategies you may want to consider include:

a) Timing your income and expenses: You can time your income and expenses to minimize your tax liability. For example, you can defer income until the next tax year or accelerate expenses to reduce your taxable income.

b) Establishing a retirement plan: Setting up a retirement plan, such as a 401(k) or IRA, can help you reduce your taxable income and save for retirement.

c) Taking advantage of tax credits: Tax credits can help you reduce your tax liability dollar-for-dollar. Some tax credits you may be eligible for include the Earned Income Tax Credit, the Child Tax Credit, and the Small Business Health Care Tax Credit.

Separate Your Business and Personal Expenses

It's crucial to separate your business and personal expenses. Mixing your personal and business expenses can make it challenging to track your deductible expenses accurately. It can also lead to errors and mistakes when filing your tax returns. Having a separate business bank account and credit card can help you keep track of your business expenses and simplify your bookkeeping.

Stay Up-to-Date on Tax Laws

Tax laws can change frequently, and it's essential to stay up-to-date on any changes that may affect your business. For example, the Tax Cuts and Jobs Act of 2017 introduced several changes to the tax code, such as a lower corporate tax rate, a newly qualified business income deduction for pass-through entities, and changes to the deductibility of business meals and entertainment expenses. Staying up-to-date on these changes can help you plan and prepare for your taxes effectively.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and fines. The due date for your tax returns may vary depending on the type of business entity you have and your tax obligations. For example, the due date for federal income tax returns for sole proprietors and single-member LLCs is April 15th, while the due date for S corporations and partnerships is March 15th. Failing to file your tax returns on time can result in penalties, interest, and even legal action.

Use Tax Software

Using tax software can help you streamline your tax preparation process and simplify your bookkeeping. Tax software can help you track your income and expenses, calculate your deductions, and prepare your tax returns accurately. Many tax software programs also offer tax planning tools that can help you identify tax-saving opportunities and minimize your tax liability.

Be Prepared for an Audit

Small business owners are sometimes audited by the IRS to ensure that they are complying with tax laws. Being prepared for an audit can help you avoid penalties and fines. Some of the things you can do to prepare for an audit include:

a) Keep accurate and complete records of your income and expenses b) Respond to the audit notice promptly c) Gather all the necessary documents and information requested by the IRS d) Consider hiring a tax professional to represent you during the audit In conclusion, managing your taxes is an essential part of running a small business. By keeping accurate records, understanding your tax obligations, taking advantage of tax deductions, hiring a tax professional, and planning ahead, you can minimize your tax liability and keep more of your hard-earned money. If you need help with tax planning and preparation, consider a reputable tax preparation services company like Jmincometax. With our expertise in business accounting and taxation, We can help you navigate the tax code and ensure that you are in compliance with all applicable tax laws.

By following these tips, small business owners can manage their taxes effectively and minimize their tax liability.

#Jm Income Tax#JM Tax And Accounting Services#Tax Preparation Company#JM Accounting And Taxation Services#Jm Individual Tax Preparation#Best Tax Preparation Services Of 2023#Business Tax Preparation#Business Accounting And Taxation#Tax Audit Representation#IRS Audit Representation

0 notes

Text

GST Consultant Eligibility Skill & certification Guide

How to Become a GST Practitioner in India

GST (Goods and Services Tax) ne India ke tax system ko simple banaya hai. Lekin businesses aur individuals ke liye GST filing aur compliance samajhna mushkil ho sakta hai. Isi wajah se GST Practitioner (GSTP) ki demand badh rahi hai. Agar aap GST expert banna chahte hain, to ye guide aapke liye hai.

GST Practitioner banna ek accha career option hai jo flexibility aur growth opportunities deta hai. Agar aapko taxation aur compliance me interest hai, to aap ye field choose kar sakte hain. GST laws aur filing ka knowledge rakhkar aap ek successful GSTP ban sakte hain. Let us discuss how to become GST practitioner in India.

GST Practitioner Kya Hota Hai?

GST Practitioner ek certified professional hota hai jo businesses ko GST-related compliance me madad karta hai. Ye professionals GST returns file karne, registrations karwane aur tax-related queries solve karne ka kaam karte hain.

GST Practitioner Banne ke Faayde

1. High Demand – Har business ko GST filing ki zaroorat hoti hai.

2. Self-Employment Opportunity – Freelance ya apna firm shuru kar sakte hain.

3. Government Certification – GSTN se registered hone par credibility badhti hai.

4. Good Earning Potential – Ek professional GST Practitioner acchi income kama sakta hai.

5. Work Flexibility – Part-time ya full-time kaam kar sakte hain.

GST Practitioner Banne Ke Liye Eligibility Criteria

GSTP banne ke liye aapko kuch basic eligibility criteria fulfill karne honge:

1. Nationality – Aap India ke citizen hone chahiye.

2. Age Limit – Minimum 18 saal ki umar honi chahiye.

3. Educational Qualification – Graduation ya usse upar ki degree honi chahiye:

o Commerce, Law, Banking ya Business Management stream se ho to better hoga.

o Chartered Accountant (CA), Cost Accountant, Company Secretary (CS) bhi apply kar sakte hain.

4. Character Certificate – Applicant ka good moral character hona chahiye.

5. Competency Test – GSTP exam clear karna zaroori hai.

GST Practitioner Banne Ka Process

Agar aap eligibility criteria fulfill karte hain, to aapko ye steps follow karne honge:

Step 1: GST Portal Par Registration Karein

1. GST Portal (www.gst.gov.in) par visit karein.

2. “Services” tab me “Registration” section par jayein.

3. “New Registration” select karein.

4. “GST Practitioner” option choose karein.

5. Apni details fill karein:

o Naam

o PAN Number

o Email ID

o Mobile Number

6. OTP verification ke baad password set karein.

7. Form submit karein aur Application Reference Number (ARN) save karein.

Step 2: Documents Upload Karein

Documents ki zaroorat padti hai:

· Aadhaar Card

· PAN Card

· Educational Certificates

· Address Proof

· Photograph aur Signature

Step 3: GSTP Exam Ke Liye Apply Karein

GSTP banne ke liye NACIN (National Academy of Customs, Indirect Taxes & Narcotics) dwara exam conduct hota hai.

1. Exam ke liye GST Portal par login karein.

2. NACIN ki website par jaakar registration karein.

3. Exam ka syllabus aur date check karein.

4. Exam fees pay karein.

Step 4: GSTP Exam Clear Karein

Exam me minimum 50% marks laane hote hain. Exam ke topics:

· GST Laws aur Rules

· GST Registration

· GST Returns

· Input Tax Credit

· E-way Bills

· Tax Payments

Step 5: GST Practitioner Certificate Receive Karein

Agar aap exam clear kar lete hain, to aapko GSTN se GSTP certificate milega. Is certificate ke baad aap officially GST filing aur consultancy services shuru kar sakte hain.

GST Practitioner Ke Rights & Responsibilities

Rights

1. GST Returns file karna.

2. Tax challans prepare karna.

3. GST Registration ke liye application file karna.

4. GST Refunds aur Audits me madad karna.

Responsibilities

1. Clients ke liye sahi aur timely GST filing ensure karna.

2. GST laws aur rules ka proper implementation karna.

3. Tax authorities ke saath compliance maintain karna.

GST Practitioner Ki Salary & Earning Potential

Ek GST Practitioner ki earning uski expertise aur clients ke number par depend karti hai. Ek beginner practitioner monthly ₹25,000 – ₹50,000 kama sakta hai. Experience badhne ke saath income bhi badh sakti hai.

GST Practitioner Banne Ke Liye Important Tips

1. GST Laws Ka Knowledge Rakhein – Regularly GST updates padhte rahein.

2. Practice Karein – Dummy GST filing aur real-world case studies par kaam karein.

3. Professional Certification Le Sakta Hai – CA, CS ya MBA hone se credibility badhti hai.

4. Networking Karein – Business professionals aur accountants ke saath connect karein.

5. Technology Aur Software Seekhein – GST filing ke liye software tools ka use karein. IPA offers GST Practitioner Course

Accounting interview Question Answers

How to become an accountant

How to become Tax consultant

How to become an income tax officer

How to become GST Practitioner

Learn Tally free online

Free Accounting Courses with Certificate

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs

ICWA Course

Tally Short Cut keys

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#diploma in taxation#payroll management course#sap fico course#accounting course#gst course#finance#business accounting and taxation (bat) course

0 notes

Text

Expert Taxation Services in Australia | Collab Accounting

Simplify your tax obligations with Collab Accounting's expert taxation services. We offer personalized advice and solutions for individuals and businesses across Australia. Maximize your refunds and stay compliant with our experienced team.

#taxation services Australia#tax compliance#tax advice#individual tax#business tax solutions#tax planning Australia#Collab Accounting#expert tax consultants#maximize tax refunds#Australian tax specialists

0 notes